Archive

A demand-supply tug of war and $100 – $200 oil prices in 2012?

In an earlier Sep 2011 article by the author, he wrote that a tug of war ensued between the elasticities of demand and supply to create range bound oil prices. The year 2012 started in earnest with dichotomous forecasts on the oil price. This is due to ongoing market uncertainties – with the Euro crisis damping potential demand and supply disruptions from the ongoing Iranian crisis. The author is convinced though this tug of war is increasingly won by the supply factors and the oil price will hinge on the upside.

Demand destruction and the Euro crisis:

During the financial crisis of 2008, OECD oil demand fell from 47.9 mb/d in 2Q 2008 to 44.2 mb/d in 2Q 2009 (IEA OMR data). Most of the demand loss came from the USA (1.8 mb/d). A look at the main demand figures from Europe during the financial crisis revealed important consumption patterns:

| kd/b (product demand) |

2008 Jun |

2009 Jun |

Change |

| France |

1870 |

1930 |

+70 |

| Germany |

2430 |

2360 |

-70 |

| Greece1 |

331 |

320 |

-11 |

| Italy |

1870 |

1610 |

-260 |

| Portugal1 |

274 |

255 |

-19 |

| Spain |

1500 |

1470 |

-30 |

| UK |

1740 |

1670 |

-70 |

| Ireland1 |

166 |

136 |

-30 |

|

TOTAL |

-420 |

The consumption demand2 has actually decreased only a marginal 350 kb/d in continental Europe with the major powerhouses France, UK and Germany having minimal impact. A key reason for the relatively low demand destruction is the use of natural gas and other alternative sources of energy in Europe (for eg nuclear in France) as a primary form of energy. The peripheral countries – Italy, Portugal, Greece and Spain in the epicenter of the crisis lost 350 kb/d of demand.

The latest economic data3 indicated that the US and China are likely to weather the contagion from Europe. More importantly central banks have learnt an important past lesson – it was the constriction of bank credit that led to the contagion in 2008 and in this respect, the European central bank (ECB) has offered low interest rate loans to banks to shore up liquidity.

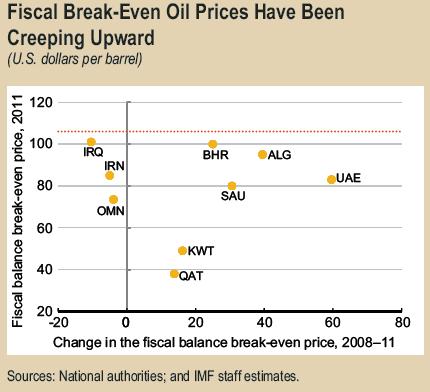

A further base on the prices – $100 was cited by Saudi Oil minister Ali al-Naimi on 16 Jan ’12 as a level to be ‘stabilised’ at. This was the first time a price level was hinted at 3 years after $75 was cited in Nov ’08. It is an acknowledgement of the growing fiscal spending by the Kingdom in social welfare and wages in its public sector to balance the government budget. A recent IMF report in Oct ’11 indicated that the break-even oil price for the Kingdom has grown by almost $30 since these 3 years.

Demand never fully restored in US post crisis:

Importantly, the US has seen a dramatic fall in oil demand from 20.24 mb/d in Jun 2008 to 18.7 mb/d in Oct 2011. Most of it is due to higher vehicle fuel efficiency and the higher average price of gasoline experienced in 2011 (even more than 2008) slashing gasoline demand by 0.7 mb/d. The USA never fully recovered its oil demand post financial crisis.

| USA demand (mb/d)4 |

2008 Jun |

2009 Jun |

2011 Oct |

Change Jun08 – Oct11 |

| Gasoline |

9.24 |

8.96 |

8.56 |

-0.68 |

| Jet |

1.59 |

1.4 |

1.45 |

-0.14 |

| Diesel |

3.85 |

2.87 |

3.76 |

-0.09 |

| Others |

4.67 |

3.7 |

4.08 |

-0.59 |

| RFO |

0.57 |

0.89 |

0.67 |

0.1 |

| Total |

20.24 |

18.04 |

18.69 |

-1.55 |

Supply disruption and geopolitical instability:

A list of existent supply disruptions issues is below. The list is not extensive with other disruptions in Libya and potential unrest in Iraq and Kazakhstan. However, these longstanding issues appear to have been ‘factored’ into market prices. A geopolitical theme permeates through the list with the Straits of Hormuz having the greatest impact.

| Region | Remarks |

| Iran (through Straits of Hormuz) | Ongoing nuclear crisis could see the blockage of the Straits of Hormuz where 17 mb/d of crude flows. Mitigating factors include the 5mb/d Petroline to Yanbu and a 1.7 mb/d Fujairah pipeline ready from UAE ready only in 2H 2012. Still, up to 11 mb/d immediate supply could be lost in a worst case scenario. Iran itself exports 2.3 mb/d of crude. Comparatively, the OECD has oil stocks of 2630mb (IEA Dec ’11 OMR). An excellent article on the cruciality of the Straits of Hormuz is found here. |

| Nigeria | Removal of fuel subsidies has triggered a strike among oil workers potentially disrupting its 2.4 mb/d of exports. On 16 Jan, the Nigerian president reinstated partial subsidy. |

| South Sudan | Landlocked South Sudan seceded from Sudan but its oil exports of 350kb/d through Port Sudan appeared to have been routed for Sudan domestic consumption. |

An observation is a relatively ‘minor’ supply disruption (in South Sudan or Nigeria) is expected to have the same order of impact as demand destruction in Europe. The author therefore postulates the supply elasticity of oil price to win this tug of war against demand, and consequently the oil price to surprise on the upside this year.

Footnote:

1 – Greece, Ireland and Portugal data are import data from EIA and not consumption data, but given that their own production is minimal, import and consumption figures should be similar.

2 – The dates were chosen as covering the period of the Lehman collapse – a defining moment of the crisis and to reflect the summer driving season in the USA.

3 – The labour market in USA is improving whilst the PMI data in China improved to 50.3 in Dec from 49 in Nov 2011.

4 – From IEA oil market reports in Aug 2008, 2009 and Dec 2011.

A case of déjà vu on oil prices?

Back in July 2008, oil prices slumped dramatically from the 140s to the 40s in a space of 6 months. Whilst not as dramatic, oil prices have fallen for some $20 over the past few weeks but have started to stay up this last week. With the world possibly on the cusp of a recession, it takes a little imagination to compare then and now.

What does the industry say?

With just three months before 2012, most banks have lowered their forecasts of Brent by some $10 to $110-115/bbl. Noteworthy is Citibank calling for a price drop by a further 10-20%. This time round, both the fundamental and speculative factors are at work – albeit differently.

Supply and demand driven

Both OPEC and the IEA have lowered forecasts of oil demand in the OECD countries by an estimated 300 kbbl/day. Whilst this demand is forecast to decrease, the oil demand growth in China and other developing countries is more than enough to make up for it. The growth in the developing countries is expected to reach 1.4 mb/day, topping overall growth forecasts to 1.1 mb/ day in 2011. Back in 2008, overall global demand destruction was about 1 mb/day.

The coming online of Libya and Kuwaiti crude, and supply curb lifts in non OPEC crude in the later part of this year are expected to add some 1 mb/day crude. In all, spare oil capacity is expected to be near 4.5 mb/ day, a level much higher than the 2008s.

Elasticity tug of war? Rangebound prices amid the tightness?

In a scenario of tight fundamentals, the price elasticity1 of oil is normally driven by its demand elasticity. However, the present scenario sees both supply and demand elasticity of oil playing a part. On one hand, the slower economic growth and increased supplies drive down prices, Yet from a global point of view, global demand continues to grow. It pays to realise that WTI prices in the USA have been some $20 lower than the global brent benchmark consistently. Such lower prices mean no further demand swing destruction in the world largest oil market.

Regulatory landscape change

In an earlier article, the author likened oil prices to be running on gears. Perhaps the oil prices are running on a lower gear now with more regulatory oversight and transparency by the CFTC? Yet aside from higher margins requirement and more transparent reporting, the regulatory landscape has not changed much. The debate to implement position limits on funds/ banks – maybe the most stringent measure has been held back pending further analysis.

Footnote:

1- Notwithstanding supply has been maximised in a tight scenario and there are no more ‘surprises’ from sudden disruptions to existing infrastructure.

Why does Oil Price Regulation in China have a minimal impact on demand?

China is now the second largest consumer of crude oil after the United States, consuming an estimated 9.6 million barrels of crude a day this year. Up to 55% of this is imported.

An understanding of how China prices its oil products is important as it determines the elasticity of its price demand. The regulation of oil products prices (in general prices of basic necessities) is performed by the National Development Reform Commission (NDRC ) a state owned body in the Chinese legislation. In many parts of the world, oil prices are subsidised to control inflationary pressures and maintain social stability. This gives a skewed picture of demand which persists even as international prices are rising. This is the case in many parts of Middle East.

Oil product prices regulation in China

An excellent historical write up of oil products regulation in China is here. Since 1998, China has regulated oil product prices (in particular gasoil and gasoline) to maintain inflationary pressures, maintain demand and supply balance and smooth out price volatilities from international markets.

In almost all measures it adopted, it adjusted its wholesale (ex refinery prices) when international prices move beyond a certain band over a certain number of days. This band and number of days have been reduced progressively in the past to tighten its linkage with international price. It however proved inadequate as it was too broad and transparent. When international prices rose too quickly, it encouraged speculative hoarding (and oil exports). Or when international prices fell too quickly as during the summer of 2008, it encouraged smuggling into the domestic markets as prices did not react as quickly to international prices). Such scenarios caused a temporal disruption in supply which has occurred as lately as Oct 10, when international prices fell too quickly.

Why China differs?

Comparing the typical income elasticity of oil between China and the developed world indicates the following:

Two features stand out – the income elasticity of China takes a shorter time to reach the peak and then decreases gently from this peak. The first is presumably to the greater technological knowledge and efficiency available to nations which modernise later. This peak then takes a longer time to decrease due to the wide income disparity between the inland and coastal regions of China. Its population size of 1.2 billion people is another factor as wealth spreads across its populace. This observation is also commented by the respected Hamilton in his paper Understanding Oil Prices.

Further China tax on oil products is minimal 20% compared to many developed countries. (300% in France, 120% in Japan and 20% in USA) effectively lowering its absolute oil prices.

Although China does not directly give out fuel subsidies, it however compensates its two largest oil companies Sinopec and PetroChina on its refining losses. For the 3rd consecutive year, Sinopec has received compensation for its refining losses, with the latest being in Dec 2010 of $1.74b.

In conclusion, the oil price regulation in China needs to be seen as a bespoke case compared to the rest of the world. These regulations shift temporal demand rather than make an absolute impact on its oil demand.