Archive

What if $150 oil happens again?

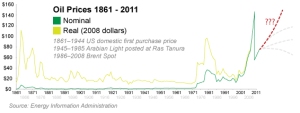

Back in July 2008, oil breached a record $147/bbl. Prior to that period, it only took 5 months for the oil price to climb from $100 to the record. The spike in prices portended a period of economic crisis as the world slipped into recession. The fall in oil price from the $150 to the $50s was equally dramatic in less than 6 months.

In recent weeks, the oil price has broken out of the range $70-80, as high inventories in the developed countries are quickly consumed by robust demand amid the improving world economic outlook. There has been chatter that oil will breach $100 (a comfortable level mooted by OPEC), or even $110 as suggested by Goldman Sachs this year, but none has been ambitious as the level $150.

The consensus is that this level is less likely to be reprised again in the near future due to the higher spare capacity 4 million bbls/day that OPEC has than the 2 million barrels back then. However, it is anyone’s guess whether supply disruptions of the sort happened again. (Back then, it was the hurricanes, ThunderHorse breakdown and the Niger oil producing delta shutdown. In a separate article, the author likened oil fundamentals to be the steering wheel while speculation to be the gearbox. The fundamentals set the direction for price growth, while speculation simply moved it to top gear.)

Instead, the author postulates what if the $150 oil price happens again. How different is the world now compared to 2008, and how will the economy react? Three factors stand out: 1) the availability of cheaper gas especially the recent discovery of shale gas 2) several new oil refineries in the Asia 3) development of renewable energies over the past 2 years

Natural Gas and substitutes

The recent advancement in hydraulic and horizontal drilling technologies has almost doubled the amount of gas reserves in USA. The availability of export gas volumes from Qatar, Australia and Indonesia has also cushioned natural gas prices from local disruption shocks. Of the 87 million/ bbls of crude being consumed each day, about 8 million bbls are used as fuel oil for power electricity generation and bunker fuel. An estimated one third of the stations in USA can substitute their fuel oil requirement to natural gas when economics permits. Further, natural gas can also substitute naphtha as a feed to the petrochemical industries. Naphtha itself is a feedstock for gasoline. The availability of natural gas can thence soften the impact of high oil product prices in power generation and petrochemicals, important drivers in world manufacturing*. (see footnote)

Refinery capacity surplus

This in turn is derived from the final price consumers pay for oil product use. Back in the 2007/08s, gasoil and gasoline cracks reached the 20s due to a temporal deficit in refining capacity. With oil refineries in Asia running at 80% run rates presently, these crack values are not expected to venture much higher. In other words, when crude prices hit $150 other oil product prices are more inelastic in breaching $160.

Renewable and other forms of energies

In 2007/08, when oil prices hit $150, the world responds through converting sugar, palm oil, rapeseed oil to bio-diesel and bio-ethanol. Land for agricultural food was converted to grow these crops in a knee jerk reaction to high prices. However, these measures proved too slow and little, as the number of bbls of equitable oil produced was less than 1 million bbls, and at the expense of increased food prices. The past two years have seen the proliferation of wind farms, solar installations and soon nuclear plants being set up in China and Europe. A rise of oil price to $150 will further expedite investments in these forms of energies and even more deep-sea and Arctic drilling.

Conclusion

In a way, technological developments over the past two years have made the world economy more resilient to oil price shocks. Increased natural gas supplies & renewables for power generation have increased substitution for oil products especially diesel, naphtha and fuel oil. Increased refining capacity means prices will be mainly crude driven and not oil products driven. As such, the author believes any jump in record prices, if ever reached will be short-lived like 2008. Back then, it was the collapse in the financial sector, but it will be technological and infrastructure resilience that has readied the world this time round.

Footnote:

*In a study by the IEA, the impact of oil prices on developed economies was concluded to be mainly driven by its oil intensity of the economy.